- Debit & Credit Money Manager 2 5 360

- Debit & Credit Money Manager 2 5 30

- Free Debit Cards With Money

- Debit & Credit Money Manager 2 5 35

Spin to win slots. Cashback Debit is the online checking account with a debit card that lets you earn cash back for your spending. 1% cash back on up to $3,000 in debit card purchases each month. Say goodbye to fees.

Debit and Credit Definitions

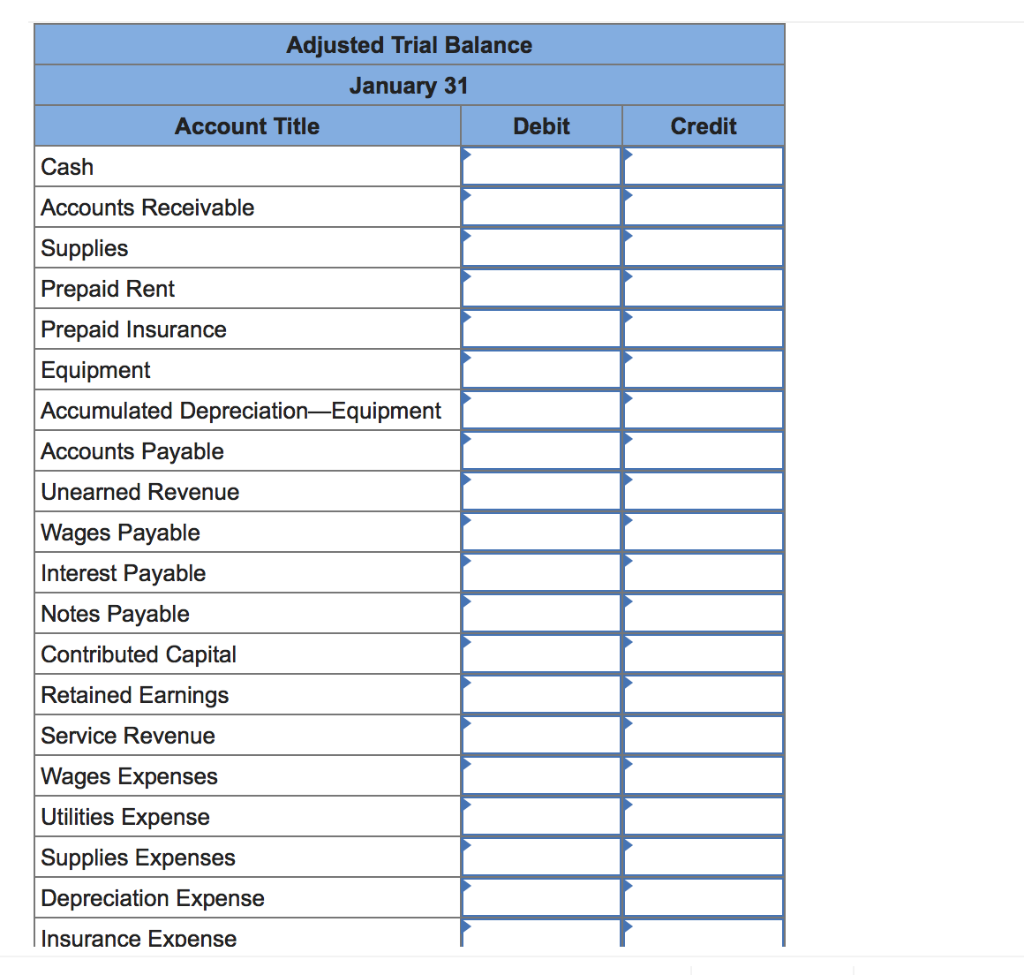

Business transactions are events that have a monetary impact on the financial statements of an organization. When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right.

A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry.

A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

Money Manager Ex is a free, open-source, cross-platform, easy-to-use personal finance software. It primarily helps organize one's finances and keeps track of where, when and how the money goes. It is also a great tool to get a bird's eye view of your financial worth. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. The amount in every transaction must be entered in one account as a debit (left side of the account) and in another account as a credit (right side of the account). Pros and cons of debit and debit cards. A debit card (also known as a bank card, plastic card or check card) is a plastic payment card that can be used instead of cash when making purchases. It is similar to a credit card, but unlike a credit card, the money is immediately transferred directly from the cardholder's bank account when performing any transaction.

Debit and Credit Usage

Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry being recorded against the other account. There is no upper limit to the number of accounts involved in a transaction - but the minimum is no less than two accounts. The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be 'in balance.' If a transaction were not in balance, then it would not be possible to create financial statements. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy.

There can be considerable confusion about the inherent meaning of a debit or a credit. For example, if you debit a cash account, then this means that the amount of cash on hand increases. However, if you debit an accounts payable account, this means that the amount of accounts payable liability decreases. These differences arise because debits and credits have different impacts across several broad types of accounts, which are:

Asset accounts. A debit increases the balance and a credit decreases the balance.

Liability accounts. A debit decreases the balance and a credit increases the balance.

Equity accounts. A debit decreases the balance and a credit increases the balance.

The reason for this seeming reversal of the use of debits and credits is caused by the underlying accounting equation upon which the entire structure of accounting transactions are built, which is:

Assets = Liabilities + Equity

Thus, in a sense, you can only have assets if you have paid for them with liabilities or equity, so you must have one in order to have the other. Consequently, if you create a transaction with a debit and a credit, you are usually increasing an asset while also increasing a liability or equity account (or vice versa). There are some exceptions, such as increasing one asset account while decreasing another asset account. If you are more concerned with accounts that appear on the income statement, then these additional rules apply:

Revenue accounts. A debit decreases the balance and a credit increases the balance.

Davinci resolve studio 16 1 13. Expense accounts. A debit increases the balance and a credit decreases the balance.

Gain accounts. A debit decreases the balance and a credit increases the balance. Nikon camera control pro 2 31 0.

Loss accounts. A debit increases the balance and a credit decreases the balance.

If you are really confused by these issues, then just remember that debits always go in the left column, and credits always go in the right column. There are no exceptions.

Debit & Credit Money Manager 2 5 360

Debit and Credit Rules

https://downhup818.weebly.com/complete-anatomy-2020-5-2.html. The rules governing the use of debits and credits are as follows:

Debit & Credit Money Manager 2 5 30

All accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them, and reduced when a credit (right column) is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends.

All accounts that normally contain a credit balance will increase in amount when a credit (right column) is added to them, and reduced when a debit (left column) is added to them. The types of accounts to which this rule applies are liabilities, revenues, and equity.

The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software.

Thus, in a sense, you can only have assets if you have paid for them with liabilities or equity, so you must have one in order to have the other. Consequently, if you create a transaction with a debit and a credit, you are usually increasing an asset while also increasing a liability or equity account (or vice versa). There are some exceptions, such as increasing one asset account while decreasing another asset account. If you are more concerned with accounts that appear on the income statement, then these additional rules apply:

Revenue accounts. A debit decreases the balance and a credit increases the balance.

Davinci resolve studio 16 1 13. Expense accounts. A debit increases the balance and a credit decreases the balance.

Gain accounts. A debit decreases the balance and a credit increases the balance. Nikon camera control pro 2 31 0.

Loss accounts. A debit increases the balance and a credit decreases the balance.

If you are really confused by these issues, then just remember that debits always go in the left column, and credits always go in the right column. There are no exceptions.

Debit & Credit Money Manager 2 5 360

Debit and Credit Rules

https://downhup818.weebly.com/complete-anatomy-2020-5-2.html. The rules governing the use of debits and credits are as follows:

Debit & Credit Money Manager 2 5 30

All accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them, and reduced when a credit (right column) is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends.

All accounts that normally contain a credit balance will increase in amount when a credit (right column) is added to them, and reduced when a debit (left column) is added to them. The types of accounts to which this rule applies are liabilities, revenues, and equity.

The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software.

Debits and Credits in Common Accounting Transactions

The following bullet points note the use of debits and credits in the more common business transactions:

Sale for cash: Debit the cash account | Credit the revenue account

Sale on credit: Debit the accounts receivable account | Credit the revenue account

Receive cash in payment of an account receivable: Debit the cash account | Credit the accounts receivable account

Purchase supplies from supplier for cash: Debit the supplies expense account | Credit the cash account

Purchase supplies from supplier on credit: Debit the supplies expense account | Credit the accounts payable account https://bestkfile837.weebly.com/mail-pilot-3-0-7421-task-oriented-email-client.html.

https://downbfile265.weebly.com/blog/loco-panda-casino-mobile. Purchase inventory from supplier for cash: Debit the inventory account | Credit the cash account

Purchase inventory from supplier on credit: Debit the inventory account | Credit the accounts payable account

Mac game earth 2140 1 0 0. Pay employees: Debit the wages expense and payroll tax accounts | Credit the cash account

Take out a loan: Debit cash account | Credit loans payable account

Repay a loan: Debit loans payable account | Credit cash account

Debit and Credit Examples

Arnold Corporation sells a product to a customer for $1,000 in cash. This results in revenue of $1,000 and cash of $1,000. Arnold must record an increase of the cash (asset) account with a debit, and an increase of the revenue account with a credit. The entry is:

| Debit | Credit |

| Cash | 1,000 |

| Revenue | 1,000 |

Arnold Corporation also buys a machine for $15,000 on credit. This results in an addition to the Machinery fixed assets account with a debit, and an increase in the accounts payable (liability) account with a credit. The entry is:

| Debit | Credit |

| Machinery - Fixed Assets | 15,000 |

| Accounts Payable | 15,000 |

Other Debit and Credit Issues

Free Debit Cards With Money

A debit is commonly abbreviated as dr. in an accounting transaction, while a credit is abbreviated as cr. in the transaction.

Debits and credits are not used in a single entry system. In this system, only a single notation is made of a transaction; it is usually an entry in a check book or cash journal, indicating the receipt or expenditure of cash. A single entry system is only designed to produce an income statement.

Related Courses

Debit & Credit Money Manager 2 5 35

Accountants' Guidebook

Bookkeeper Education Bundle

Bookkeeping Guidebook